How will next April’s Help to Buy changes affect new home sales?

The Help to Buy Equity Loan Scheme, launched in 2013, has helped more than quarter of a million households in England purchase homes, including 51,000 in the 2019-20 financial year.

A revised Help to Buy: Equity Loan scheme 2021-2023 comes into effect next April, and will differ in two key respects from the original scheme:

- Only first-time buyers will be eligible

- Regional price caps (set out in Table 1) will replace the £600,000 cap that currently applies nationally

Help to Buy sales represent more than a third of housebuilders’ overall housing output and an even larger share of new home sales in the open market, and so both changes are likely to be significant for developers and the wider housing market. We look at each briefly in turn.

Limiting the scheme to first-time buyers

While the vast majority of Help to Buy purchases – about 82% – has been taken up by first-time buyers, that still means that the reach of the new scheme will shrink by a fifth from now (and potentially by more, depending upon the precise definition of first-time buyers going forwards).

The impact will not be felt evenly across England, however, given that the importance of the HTB scheme and its take-up by movers varies across local authorities.

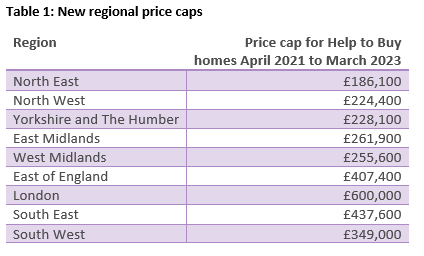

We can get a sense of what this means, by looking at the number of movers who took advantage of Help to Buy in 2019-20 (the latest period we have detailed information for) relative to open market sales, as reported by HM Land Registry. This is shown in Figure 1. We should avoid reading too much precision into the analysis, given that we have had to marry up separate datasets, but the colour shading is important here, with darker shades of purple indicating a more negative picture. In some cases, such as Somerset West and Taunton, where Help to Buy accounted for three-quarters of new home sales (as reported by HM Land Registry) and 30% of households using HTB were movers, as much as a fifth of all new property sales could be at risk.

Broadly speaking, the Midlands, South West and southern England appear likely to be most adversely impacted as a result of movers not being able to use the new Help to Buy arrangements.

Regional price caps

As can be seen from Table 1, there is a wide disparity in the regional price caps that have been set.

Where the caps bite, this will of course shrink the pool of new properties that are available for purchase under the Help to Buy scheme. Movers currently account for a disproportionate share of higher-ticket purchases using Help to Buy, but they will be excluded from using the new scheme anyway. While we need to avoid double-counting such buyers, we do not have the underlying data to do so, and this makes it hard to provide a definitive view as to how these caps will affect future Help to Buy activity.

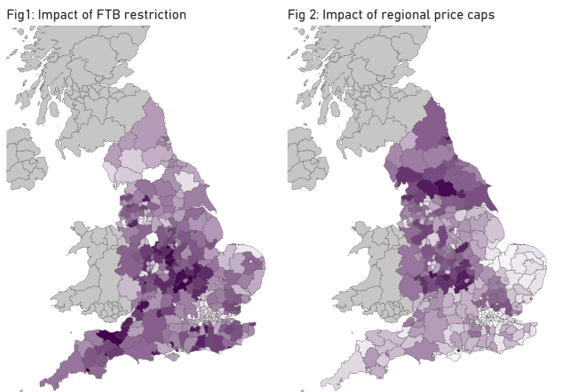

That said, it seems reasonable to infer that the extent to which the new regional price caps would have shrunk the eligibility of last year’s pool of new home sales for Help to Buy gives some direction of travel with respect to detriment. This is shown in Figure 2, and follows a similar shading convention as Figure 1.

Interestingly, the geographic picture differs materially from Figure 1. It is northern England that is most adversely affected and also the Midlands.

When facing these regional price caps, the likely behavioural response of first-time buyers is unclear. In extreme cases, for example Harrogate and York, the regional price caps look set to preclude nearly all of last year’s Help to Buy sales, and so may be a game-changer.

Elsewhere, and perhaps for many, the post-Covid tightening of lending criteria and reduced availability of higher loan-to-value mortgages may mean that Help to Buy is the only game in town, and the choice may be between buying a smaller home using Help to Buy or not buying at all. And for others, there may be attractive alternatives amongst the numerous new home sales that already take place outside the Help to Buy framework.

Concluding remarks

One interesting take-away from the two Figures is that London appears relatively unscathed by the forthcoming Help to Buy changes, with its first-time buyers accounting for nearly all current Help to Buy sales and the regional cap for London matching the current national one. Parts of the Midlands, meanwhile, look like they will be adversely affected, both by the exclusion of non-first-time buyers and the switch to regional price caps.

It is also worth noting that the proposed change in Help to Buy arrangements coincides with the scheduled end of the current stamp duty concessions, so injecting an unhelpful degree of uncertainty as we head into the traditional spring house-buying season.